- Liquidity in the Art Market

- Facts to Analyze Liquidity

- 10 April '19

by Robert McIntosh

10 April '19Liquidity in the Art Market

It is a natural concern for any investor allocating capital in art to consider its relative illiquidity when compared to most other traditional financial assets. However, art’s qualities as an investable asset overcome any liquidity matters because of overall long-term benefits in an investment portfolio. Art has less volatility the longer the holding period with the same rate of return. Contrary to many opinions, art can also produce dividends from efficient active management strategies.

Art is an illiquid asset because selling artwork is not an immediate process despite the mechanism used. Dealers, auction houses and art galleries usually incur in complex processes to complete a (bought and sold) transaction between a buyer and a seller. Furthermore, transaction costs are much higher in the art world than in most financial markets.

Despite many investment qualities, when simply collected and not securitized and diversified fine art often is an illiquid asset. However, it is precisely its illiquidity that makes it a safe and lowly volatile investment vehicle when compared to traditional investment instruments. This specific characteristic is what makes art such an attractive asset to portfolio managers because of the low correlation with financial instruments. Moreover, in the art market, there is a practical impossibility of a collective panic situation, as opposed to stocks that can suffer from a double-digit decline in a single session.

Simple Observable Facts to Analyze Liquidity

There are several ways to study the liquidity of an artist or art sector. It can be estimated by looking at specific facts from past auction results. However, one cannot base a decision on which artist to invest in by just looking at this number. An informed investor will take into consideration many other factors and follow a proper due diligence protocol, like in real estate.

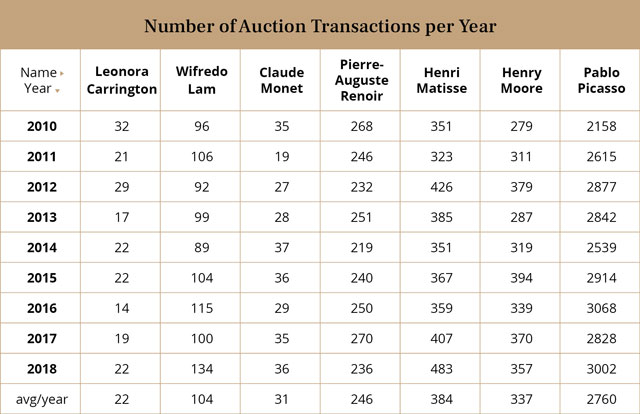

Guidelines to be considered when analyzing for several liquidity numbers can be reviewed; for example, the number of artworks auctioned throughout a year from a particular artist compared to those of his peer artists. The interpretation is very simple; a higher number of transactions can represent higher liquidity. This number is indicative of the size of an artist’s market not in monetary terms but in terms of how productive the artist is, or was, during his lifetime. However, a small market in terms of transactions like Monet’s could also be interpreted as a very unique and attractive liquid market, this fact is confirmed when looking at the unsold rate of his artworks.

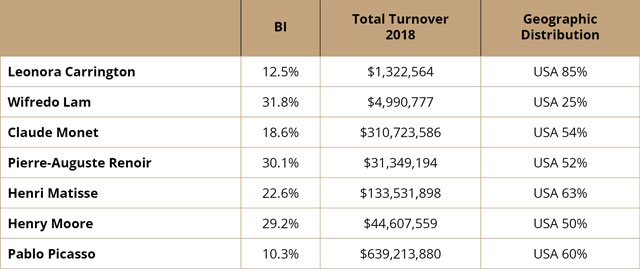

Another useful reference could be the BI Rate (Bought-In); this number indicates the average share of unsold artworks by an artist or art sector. The BI has many useful readings, but in this case, it can denote the level of difficulty and risk of selling artwork in an auction, considering this as a proxy for the entire art market. A very low BI is indicative of high demand and probably a more liquid market for an artist or sector. The total turnover shows the size of the artist’s market in monetary terms, a larger market represents more securitization opportunities. This number can also be used to estimate the average price per artwork in each corresponding market. The geographic distribution shows where in the world the majority of transactions are completed for each artist, this is a useful number when looking for a market to place an artwork. In a certain way, it could be interpreted as where in the world the market is more liquid. Following with the analysis of Monet’s market, his very low BI rate confirms that despite the very few transactions each year on the market (avg. 29), the risk of selling his artworks is very low, especially if sold within the USA.

With particular artworks, there are several factors that can increase or decrease liquidity. By simply considering some of the inherent characteristics of each artwork one can assume the difficulty of converting an asset into currency. For example, physical aspects like size and conservation issues should be considered when analyzing liquidity. It is generally harder to place in the market a 4 x 6 m. artwork than a 1 x 1 m. because of transportation and maintenance costs. All of these statistical facts are very simple to interpret and can help minimize the exposure to liquidity risk when investing in art.

A specialized market like the art industry needs specialized information and know-how protocols in order to make efficient and optimal decisions. Even if art is an illiquid asset its benefits when included in an investment portfolio are more valuable than its complications. Besides, liquidity is only one of the aspects that need to be taken into consideration when analyzing an artwork or sector to invest in.

The art investment industry is undergoing a development process and very few institutions have managed to build a solid track record so far. However, as financial specialization continues to permeate in the art market, issues such as art’s liquidity will cease to be a problem for investors. We believe that the natural evolution of art funds will create a secondary market for investors that are not keen on mid-term investments closed-end structures but are nonetheless looking to invest in art.